A few months ago we looked at Accenture’s Banking Technology Vision 2017, and of the report’s numerous highlights, those centered on AI were particularly noteworthy:

- Seventy-nine percent of respondents agree that AI will revolutionize the way banks gain information from and interact with customers

- Twenty-nine percent believe it is extremely important to offer their products/services through centralized platforms/assistants or messaging bots.

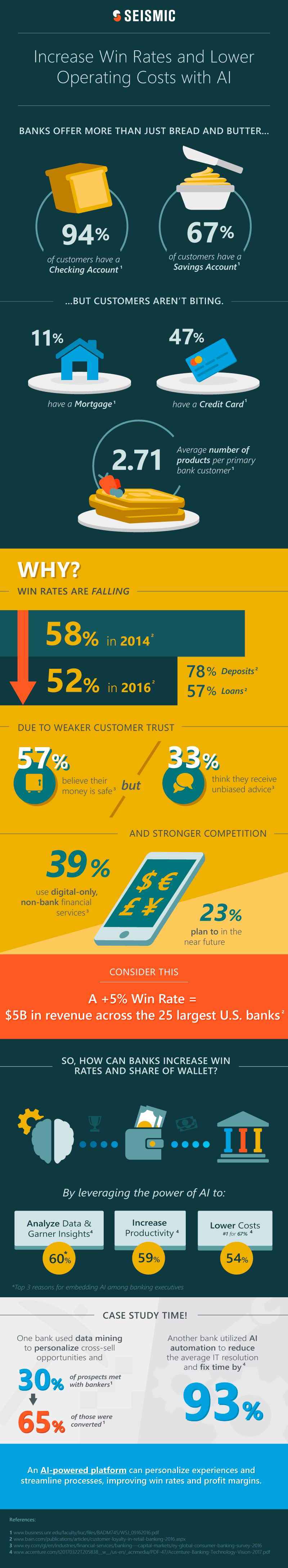

- Bankers’ top three reasons for embedding AI into user interfaces are data analysis and insight (60 percent), productivity (59 percent), and cost benefits/savings (54 percent).

Continuing this topical thread is The Financial Brand’s recent reference of EFMA’s report, Getting Ahead with AI: Transforming the Future of Financial Services. A few of the key AI opportunities cited by EFMA are:

- Lowering costs and increasing revenue

- Improving the customer experience

- Boosting customer engagement

But how exactly does the introduction of AI work in favor of banks looking to seize such opportunities? What does that relationship, when incorporating existing market dynamics, look like? And, most importantly, to what extent can banks expect a measurably positive outcome? Take a look at the below infographic for answers to all three.