Asset managers are under the gun to adjust their operational models and expand margins in the face of prevailing headwinds. This isn’t some 2016 narrative; it’s language adapted from a FundFire article published today. In the piece, a survey commissioned by State Street and conducted by Longitude Research cites that 66 percent of institutional investors say they believe growth has become more difficult to achieve in today’s environment.

“There is a group of firms who appear to be acting complacent and saying ‘Let’s stay the course and do what we’ve always done. Eventually markets will return and we will be fine’,” said Jeffrey Levi, a principal at Casey Quirk, a practice of Deloitte Consulting. “Our view is that that group of firms will see significant margin compression and many of them will go out of business or will be acquired by others for scale.”

With average industry margins falling from 34 to 31 percent over the past decade, and most experts forecasting a continued slide to 20 percent over the next five years, it’s imperative for firms to take a serious look at how they do business rather than wait for another proverbial rising tide.

State Street reported that respondents who were proactively and aggressively investing in technologies like automation and artificial intelligence had experienced higher levels of success in meeting their growth targets over the past 12 months.

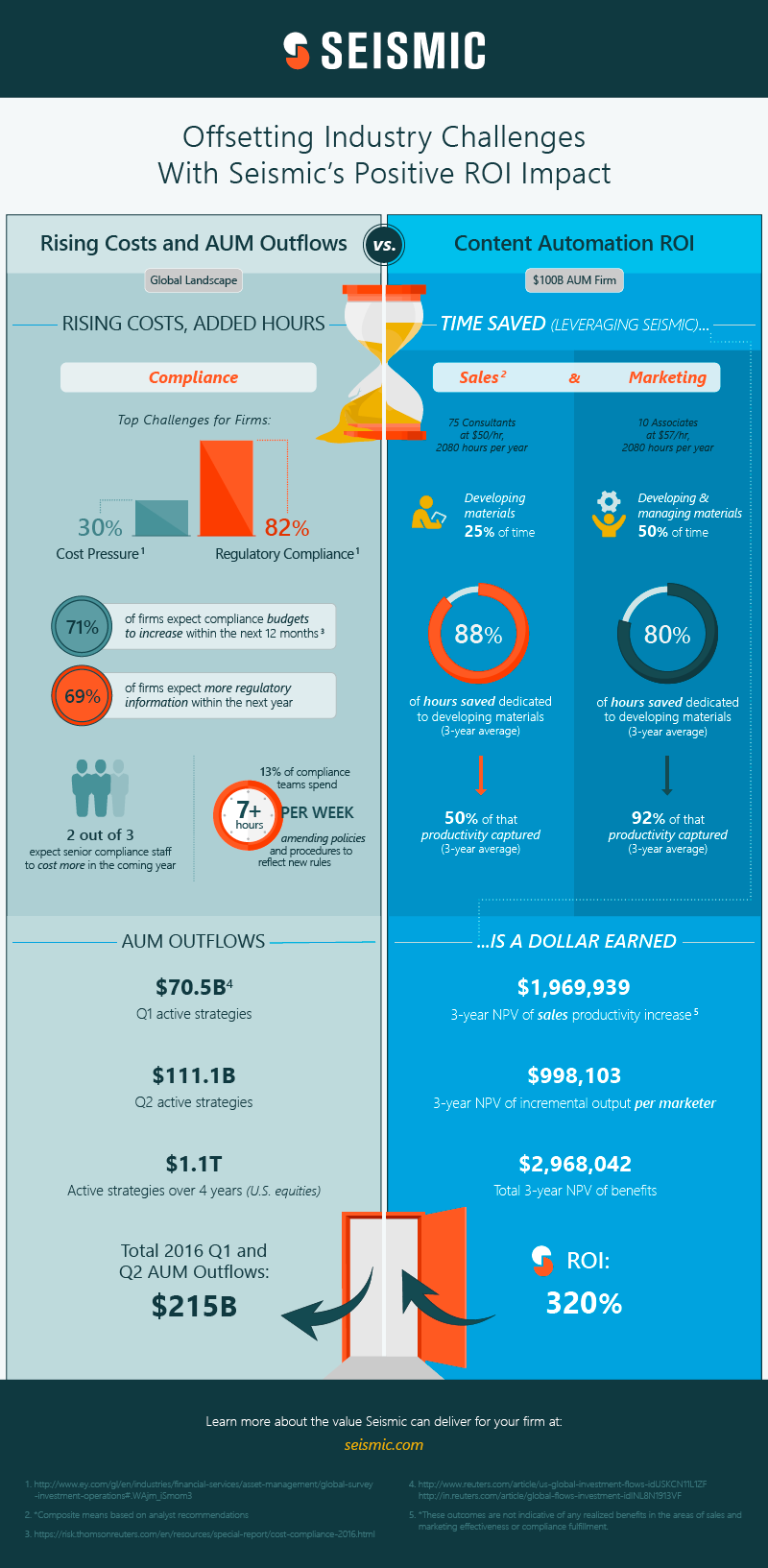

But how can firms define success when it comes to purchasing and implementing a solution? Which operational factors should be analyzed in order to offset industry challenges? As an example of what the technologies cited by State Street can offer asset managers, Seismic contrasted the current environment’s costs with the ROI an advanced solution can deliver. Here it is in a nutshell, or rather, an infographic: