Shaalin Parekh hosted a webinar in conjunction with Bobby Martin from Vertical IQ and Jim Marous from The Financial Brand. You can see the full webinar here.

Over the past few years, banks have been increasingly focused on using big data, artificial intelligence, and advanced analytics to create more personalized experiences for their clients. In fact, according to a recent survey from The Financial Brand, it’s the most important trend that B2B and retail banks see shaping the industry in 2020 and beyond. Among the catalysts for this trend is the fact that today’s clients have grown impatient. They simply won’t tolerate working with banks that don’t know who they are, what matters to them, or even what their last interaction was. Similarly, they have no interest in receiving emails and other communications that aren’t relevant to their needs.

“9 out of 10 Companies report that their bank provides them with no industry-specific information that can add value to their business.”

Barlow Research Associates, inc. Small Business Flash Panel February 2017

The irony here is that as a bank, chances are that you actually know a lot about your clients. In fact, you probably have vast troves of data about them. The problem is that most b2b banks don’t do a great job of using that data to create personalized, contextually relevant interactions with their clients.

Personalization is the Key to Becoming a Value-Add Advisor

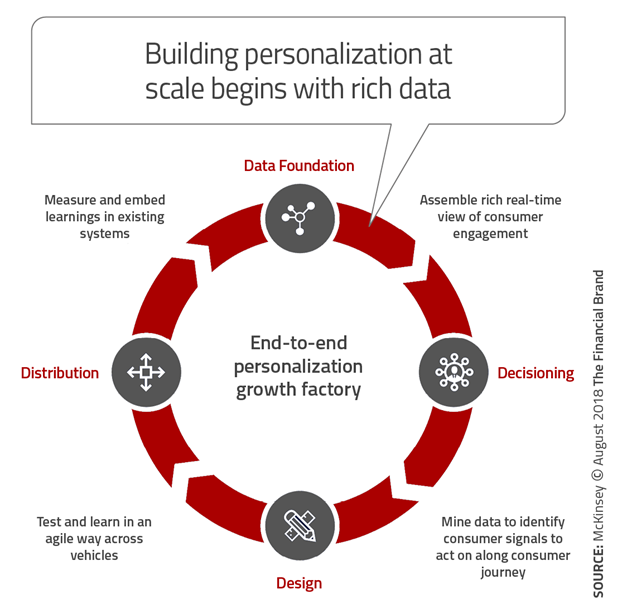

To get around this problem, engage clients, and actually add value, banks have to start delivering more personalized experiences. The key to pulling that off is finding ways to apply the data and analytics they already have to drive personalized engagement while also better meeting their clients’ needs. To do so, banks and relationship managers have to:

- Have innovative talent who understand digital technologies

- Use structured and unstructured data to deliver breakthrough insights

- Leverage the power of the cloud to integrate data across platforms

- Utilize integrated automation, smart analytics, and AI to transform operations

- Seek out smart partnerships to drive innovation further

It’s only when you use data to build deeper interactions with your clients that you’ll be able to stand out from your competitors and win. Of course, creating personalized interactions is only one piece of the puzzle. As an advisor, you also need to ensure that you’re always delivering value. Practically speaking, that means making sure that you always:

- Understand your clients’ business. Know everything you can about their business, including what trends are shaping their industry, who their competitors are, and what regulations, if any, they need to comply with.

- Have strategic conversations with them. Once you have that understanding, it’s important to demonstrate you know how their business works and how you can help them solve the financial challenges they face. Show them that you’re invested in helping them meet their objectives.

- Offer personalized advice. Think through everything that you know and bring your clients fresh perspectives that are tailored to their individual needs. In the process, make sure that any advice you offer is always tied directly back to their objectives.

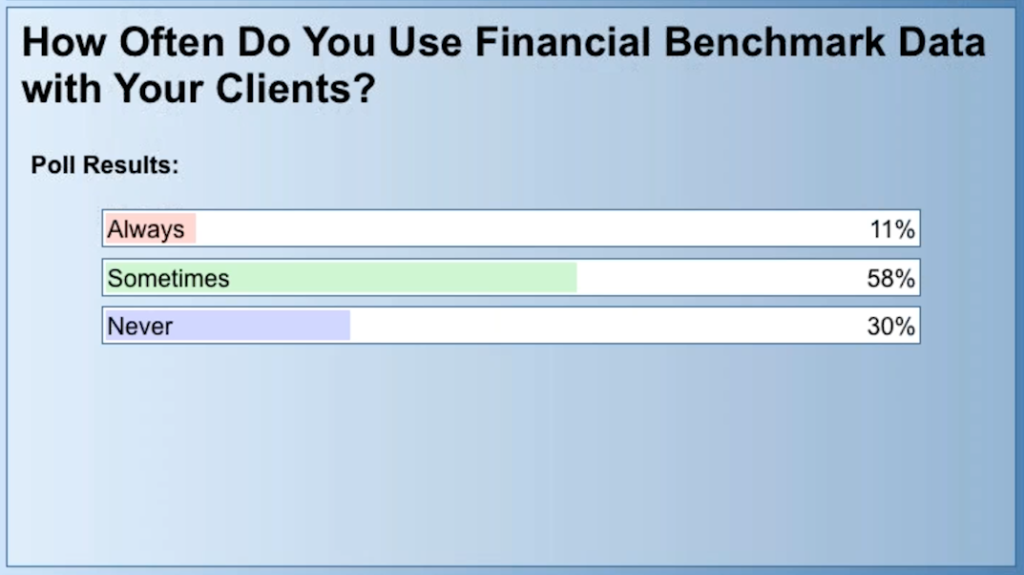

While this personalized approach may seem obvious, it doesn’t always play out this way in real life. Consider, for example, that just 11 percent of relationship managers say that they always deliver client-centric presentations. Most (58 percent) report that they only do so some of the time, while nearly one-third (30 percent) say that they never do. That simply isn’t good enough to keep up with the demands of today’s clients.

“How often do you use financial benchmark data with your clients?”

Software Offers a Solution

Today’s relationship managers are under growing pressure. Not only are they having to compete with other banks, other non-bank lenders, and fintech’s, they’ve also got more clients to manage. Plus, they’re being asked to cross-sell additional products like never before. What all of this means is that they’ve got a lot on their plate, which makes carving out the time to create personalized experiences difficult.

To overcome these challenges, leading banks are increasingly turning to software for help. With the right sales enablement platform, for example, they’re able to automate the personalization process. A good sales enablement platform will allow them to manage all of their content in one place, making it much easier to access. The right platform will also make it easier for relationship managers to find what they’re looking for, personalize it, and distribute it to their audiences. Finally, because these platforms provide robust analytics, it becomes much easier for relationship managers and the people who support them, to drive insight-driven sales and marketing decisions.

At a time when personalization has become a strategic priority for banks, you can’t afford to miss a single opportunity to deliver it. Ensuring that all of your client communications are customized for their intended audience is a great place to start. To learn more, speak with our team.